Marco Annunziata

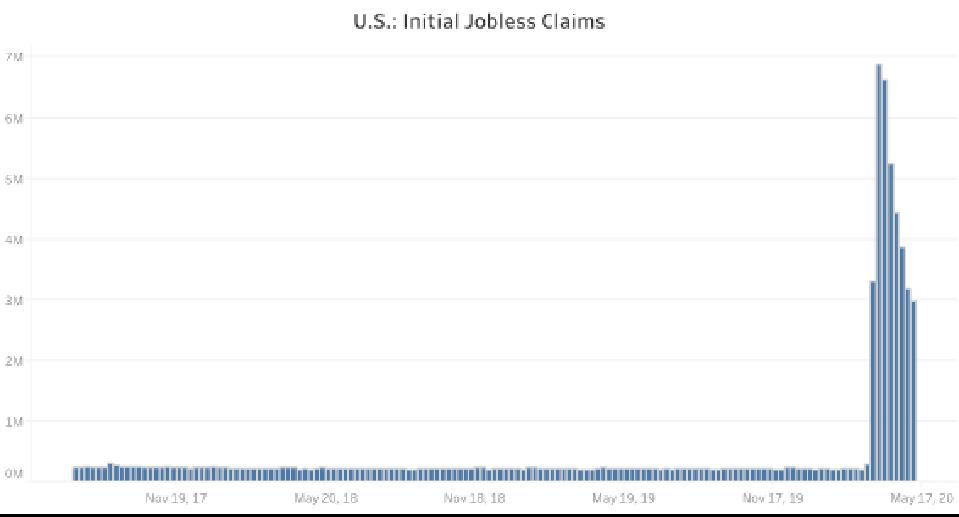

The collapse in employment levels of the last couple of months has been so devastating that our attention has been totally captured by the headline numbers: close to 40 million Americans have filed for initial unemployment claims since March 21st; the broader measure of the unemployment rate, U6, which includes people marginally attached to the labor force, has jumped to nearly 23% in April from under 7% last December. A glimpse at the charts quickly brings home the unprecedented speed and magnitude of this jobs loss.

Exactly because the headline numbers are so large, however, it is important to pay close attention to the trends on the ground in specific industries and occupations. These can give us crucial information not just on how quickly the labor market can rebound, but also on which occupations have better prospects for the long term—given that the impact of Covid-19 might bring structural changes to the makeup of our economy and our labor market.

Klein Tools is a company that enjoys a particularly favorable vantage point to see what’s happening with skilled trades jobs across the US economy. Headquartered in Illinois, Klein Tools has been in operation since 1857 and has steadily expanded its operations over the course of these 163 years. It produces a wide range of hand tools used by workers in electrical occupations, in construction, manufacturing, telecommunications and other infrastructure sectors.

Klein Tools President Mark Klein notes that even though many of the activities which employ their tools have been classified as essential, small business owners and self-employed skilled trades professionals have also been suffering in this sudden economic contraction: the desire for self-distancing has adversely impacted demand for their services, and supply chain disruptions have caused scarcity of some materials needed in their operations. Essential-business status has helped—electricians have played an important role in the setting up of additional emergency health care facilities in some areas like New York; but the widespread nature of the downturn has hit these trade occupations hard.

On the positive side, though, Klein notes that the support measures adopted by Congress and the Administration have had an immediate impact: “We saw a sharp fall in sales in March, but when the stimulus checks arrived in April our sales quickly bounced back, showing that a lot workers in these sectors were eager to get back to work.” Meanwhile, like everyone else Klein Tools had to react quickly to the changed circumstances—with the added difficulties of a business where occasional working from home was not as common as in tech or in finance. “Our customer service department is based in Chicago—says Klein—and we had to quickly get laptops for all our employees so they could work from home.” At the same time, Klein Tools has benefited from the fact that the vast majority of its production and supply chain is based in the U.S..

Meanwhile, Klein Tools also exemplifies the positive role that businesses with strong financial shoulders can play to help the economy weather the downturn: it is still paying rent for its temporarily empty Chicago offices; and most importantly, Klein notes that the company has not furloughed or laid off any of his employees. “We are taking the hit on our bottom-line, of course, but we want to take care of our employees, and we also know this will allow us to move faster as business starts up again”—says Klein.

And indeed Klein Tools is already seeing signs that the recovery of jobs in these areas has started and that it might be quick, especially as there is substantial pent-up demand. Moreover, if some industries make a more permanent shift towards remote working (some large tech companies have already indicated they might), this will increase demand for installation of audio and video equipment as well as for the upgrading of cabling and networking infrastructure.

This might be compounded by the need to upgrade the digital communication infrastructure as more and more companies step up the adoption of digital-industrial technologies, which might become a more urgent priority to improve both the efficiency and the resilience of operations.

Employment in blue collar trades could then bounce back faster than other occupations—and that would provide an important signal to young people planning their future careers. This is an area that over the past years has experienced a growing skills gap, as a larger share of young people aimed to go to college and then on to a white collar career, in many cases discounting blue collar skilled trades like electricians, plumbers and welders as less attractive. A similar trend has been apparent across manufacturing industries, triggering concern that as the older and more experienced generations of technical workers retire, there is a very limited pipeline of younger workers ready to take their place.

Klein Tools has been actively engaged in the effort to improve the perception of these occupations, showing to young people that these are rewarding jobs that require a high level of technical skills and can yield attractive compensations. Most recently, Klein Tools partnered with San Francisco 49ers quarterback Jimmy Garoppolo, and his father Tony, to encourage and recognize students aspiring to a career in skilled trades. Garoppolo’s father had a 40-year career as an electrician in Chicago, so the young quarterback has a very personal connection to the trade.

As the aftershock of the pandemic reshapes the labor market starting from extremely high unemployment levels, faster growth of opportunities in skilled trades might attract a lot more people to those careers; this could accelerate the recovery, reduce the skills gap and help put the US economy on a more solid and resilient growth path.

Read the original article here: https://www.forbes.com/sites/marcoannunziata/2020/05/26/why-skilled-trades-can-lead-the-jobs-recovery-and-enjoy-a-brighter-future–klein-tools-front-line-insights/#1621754562c9